The worst is behind us, but we are not out of the woods

2023 was surely a year to remember in the world of real estate. It will go down in history as the year with the lowest number of sales in at least a decade, and in some states, over two decades. My prediction last year that 2023 would be 1982 all over again unfortunately ended up being accurate. Although truth be told, on a local level, sales were down even more than I predicted. Nationally I had predicted about 4 million sales, and it looks like it will come in right around there. The good news is, I feel that 2023 is the worst of it and it will be the slowest year of this downward cycle, as I said it would be last year at this time. However, I do not feel that we are out of the woods or see 2024 as dramatically better, as far as overall sales go.

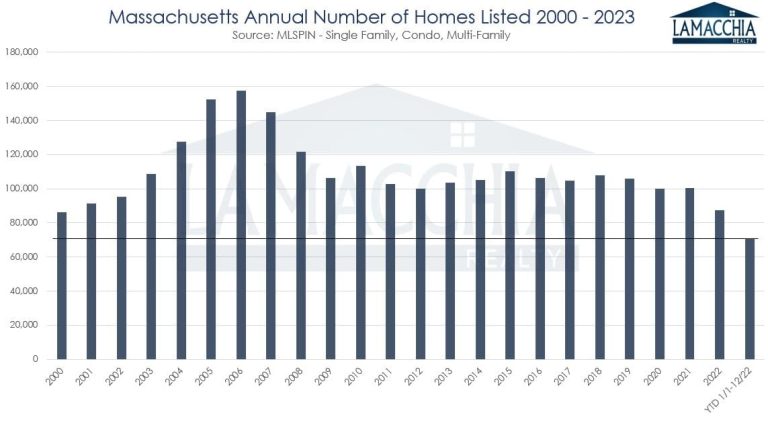

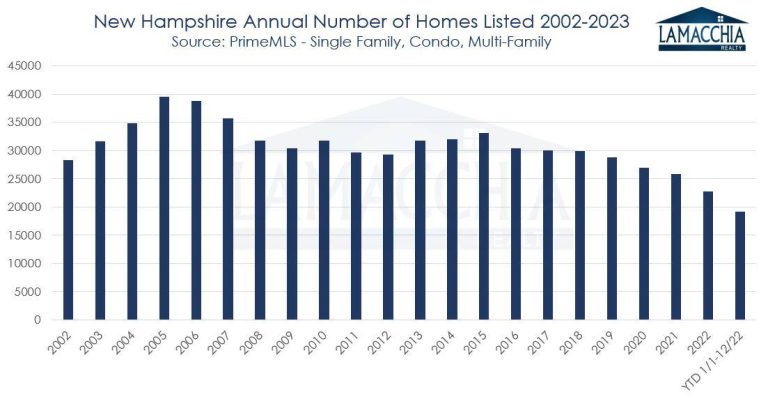

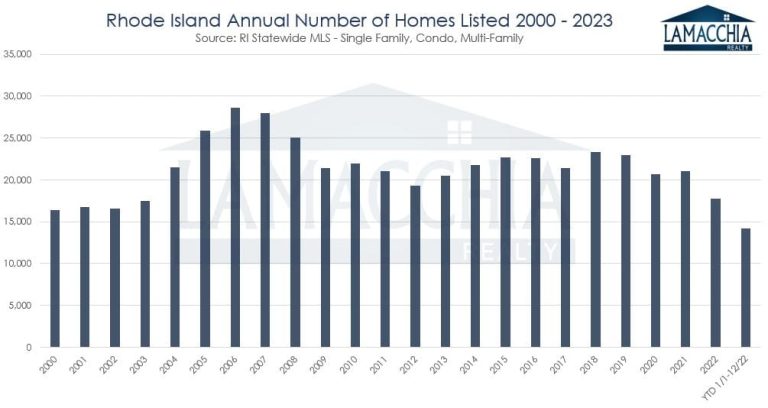

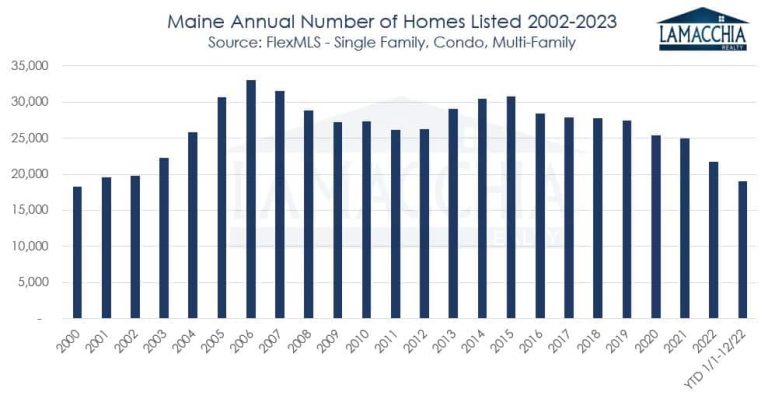

Allow me to go through a brief 2023 recap before I go onto my 2024 predictions. The first thing I want to address about 2023, is just how few homes were listed. It’s simply fascinating to see. In typical rate rising cycles, there is a lack of buyers. The unique thing about this time is there is a major lack of sellers because no one wants to give up their low mortgage interest rate. The problem (or the good news) depending on how you look at it is over 89% of homes with outstanding mortgages have a rate below 6%. We have a country full of homeowners who refuse to sell because they don’t want to lose their rate! As you will see in the charts below, 2023 will go down in history as the year with the least number of homes listed in this century.

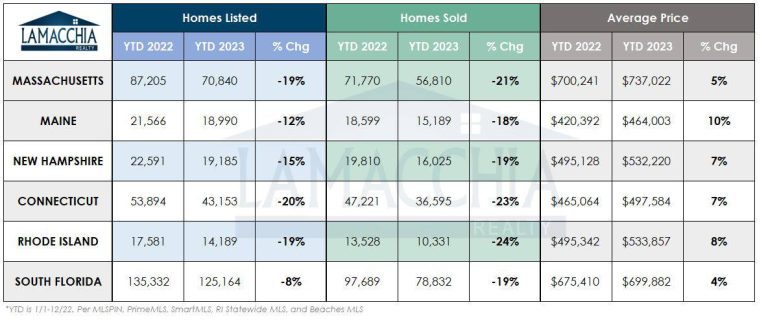

We serve Massachusetts, New Hampshire, Connecticut, Rhode Island, Maine, and South Florida so we thought it would be best to lay it all out on a simple table so you all could compare state to state. The 2023 market was pretty much the same with slight variations state by state as you will see in this recap table below. Bear in mind the data in this table is up until the 22nd of December and doesn’t include the last 9 days. However, we do not expect any major changes once that data is in, so this gives everyone a pretty accurate picture of things.

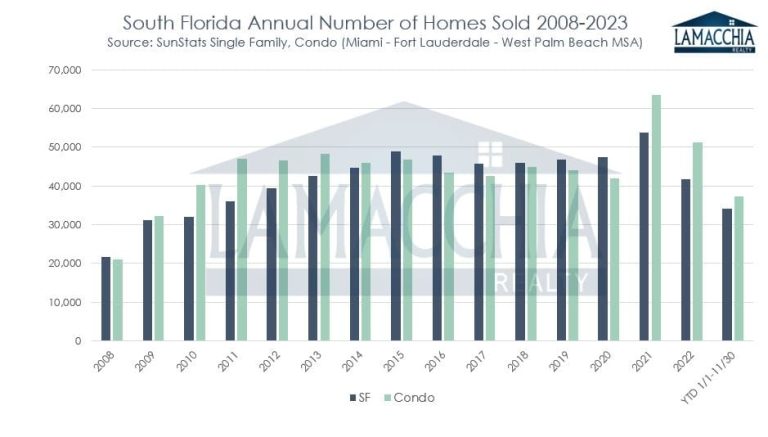

When I look at this chart the first thing my eyes go to is the fact that the South Florida market which consists of Miami Dade, Broward and Palm Beach counties is so much bigger than any New England state! 125,000 homes listed in just SOUTH Florida is amazing! But listings are only down 8% where all of the other states are down at least double that. That is why we are seeing inventory rising in South Florida and properties sitting longer; especially condos as the new condo regulations are having much more of an impact with all the towers along the water, we are seeing even more inventory, more price adjustments, and more properties sitting on the market. In my view, South Florida is a year ahead of the northern states with this market adjustment, though I don’t think that New England will experience as much of an adjustment with pricing as I am now expecting to see in Florida. Always remember that Florida has higher highs and lower lows, which has been typical over the last 50 years. I will get into this further in my predictions.

Now for my 2024 predictions!

Overall Sales

I do think 2024 will yield similar circumstances to 2023 with the market being slow overall, but there will be a bit more sales, and it will be the year that things start to improve and head back to normalcy. From what I can tell, sales will be up somewhere between 2-7% compared to the final numbers of sales for 2023, which won’t officially be out until late January 2024. I see that happening for a few reasons. First, rates have come down somewhat recently and I expect them to come down more as we get into next summer and fall. Second, sellers can only hold off for so long. People have life needs and many have held off for 18 months. They will start to enter the market in higher volumes. You can delay moving up to buy a bigger home or downsizing for a while, but eventually life needs come up and force your hand. People have babies, people pass away, people get divorced, people get relocated for jobs. Real Estate never truly stops, it just slows down once and a while.

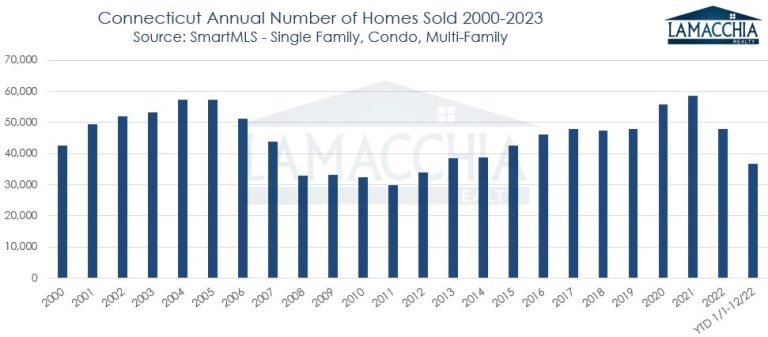

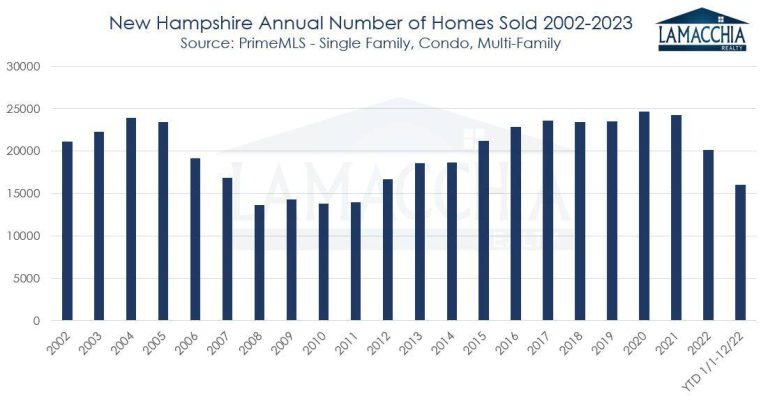

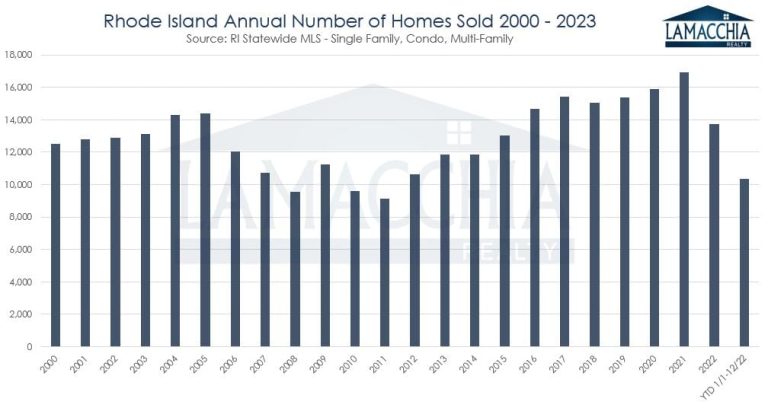

Below are bar graphs of home sales per year, dating back to the first year we had data in our northern states:

As you can see it is no doubt slow, but sales are not quite as slow as they were from about 2008 to 2011.

Below is a bar graph that illustrates the number of condo and single family sales per year in South Florida since 2008. You’ll notice that 2021 was just an incredibly historic year (like everywhere else in the country) and 2022 exhibited a correction with sales back to lower levels. Please note 2023 only goes from January to November since December numbers aren’t out yet so those 2023 bars will end slightly higher.

Will prices go up more? Or down?

The reason I expect a softening in pricing, though I’m not 100% sure, is that I predict when rates go down, more and more people will list. Granted this may take until the spring of 2025, but I do think as more people list, the supply will rise high enough that prices will soften a little due to fewer buyers needing to outbid one another, and more price adjustments as homes linger on the market longer. We are already seeing this in Florida especially with condos. And, I do recall seeing a similar move once before back around 2006-2007. Again, just as I said a year ago in my 2023 predictions, the softening in prices will be nothing like what we saw in 2008, there just isn’t enough inventory.

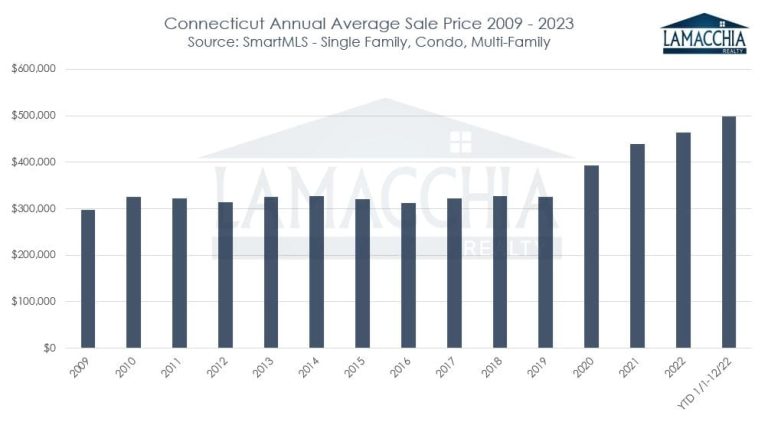

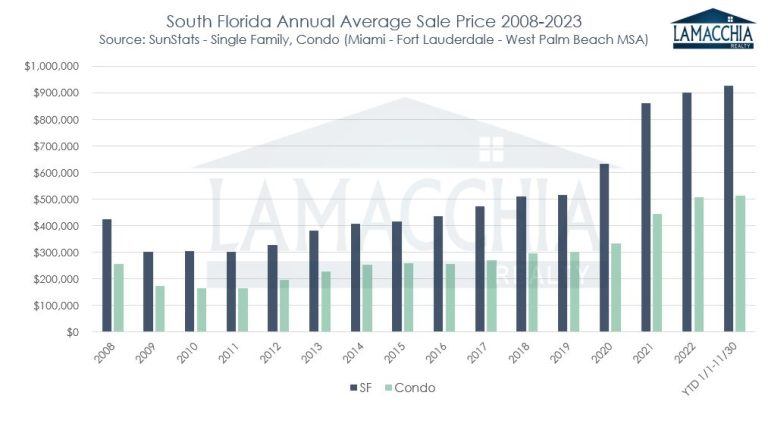

In the charts below, you’ll see that prices in 2023 are undeniably higher than in 2022, or really ever before. Rising prices and low inventory go hand in hand as supply is insufficient and therefore buyers are competing, which drives prices up. Every northern state we are in, had an increase in prices as you can see below:

As you can see above, prices in South Florida for single family homes went up, but if you look closely, you will see how condos have already flattened out compared to 2022.

My official pricing predictions for 2024 are as follows:

Northern states: Prices will be essentially flat, which means prices in 2024 compared to 2023 will be somewhere between down 3% to up 1%. Early in ‘24 we will see bidding wars and prices running up, but by summer that will soften especially as rates come down and more people list. Although, Connecticut may be the outlier where prices could continue going up due to its excessively low inventory.

In South Florida: I expect prices to go down somewhere between 3%-5% with single families and a bit more with condos. Condos will go down something more like 5%-8%. The increasing rental inventory and decreasing rents also tell us this will happen, because history shows, once rents come down to the point that they don’t cover the mortgage and other expenses, owners end up listing for sale. Expenses are going up with condos as condos fees are going up and special assessments are being put into place. The wild card here is Miami, which may be the county that props it all up since not only high volumes of people, including companies, are continuing to move there but it’s a big attraction to the higher end buyers. This deceleration should be welcome news for buyers, and they should strike while they can, because this slowdown won’t last long as there is just too much demand to be in Florida.

Mortgage Rates

Last year I made some very bold statements on what I expected with mortgage rates, predicting that it would take a while for them to go down and that they would actually go back up again before they went down. I specifically said,

I need to give credit to my Senior Advisor, Gerry Bourgeois, who was even more accurate than me or anyone. He said rates would go up more, and it would be later than summer before they started to go down, and he was right! Once we got to about July it became clear to me and Gerry that rates were likely going higher than the 7’s into the 8’s, as I explained on Boston25 in Mid-September.  They ended up peaking at 8% in early October and the truth is the biggest reason rates fell over the last 6-8 weeks, was the conflict in Israel that caused investors to switch back to buying bonds.

They ended up peaking at 8% in early October and the truth is the biggest reason rates fell over the last 6-8 weeks, was the conflict in Israel that caused investors to switch back to buying bonds.

I find it interesting that last year in my predictions, I was talking about how rates at that time had come down in the last 6-8 weeks, and here I am, two days before Christmas, essentially saying the same thing about this year. They tend to come down around the holidays and then go back up in winter.

This means that we could see 7% mortgage rates again. But I suspect we will likely hover in the mid to high 6’s for a while. Once we get to summer and fall and the economy begins to crack more, I do expect that we will see rates come down in a much more meaningful way and probably end next year in the low 6’s or possibly even the high 5’s.

As you can see in the chart above, rates in the 5’s and 6’s are historically moderate, and we have been spoiled due to the pandemic rates, which were never going to last. The rates had to rise to help level out the market and the Fed had to mitigate inflation, with the goal of eventually finding equilibrium. When they decrease to the 5’s or low 6’s, we could see more sellers come out of the woodwork, supply could increase, and this would be the scenario where we’d see prices soften, or at the very least, level out. It really depends on how long it takes rates to go down into the 5s. If it’s late in the year, any significant increase in the number of homes listed will happen in 2025.

In the meantime, for those motivated to get into a new home now, particularly due to life changes, divorce, or relocation, buyers need to use mortgage buydown options, mortgage assumptions and other creative financing options to get the deal done.

Conclusion

The bottom line is: I think sales will be up in 2024 over 2023 and I think the price increases will slow way down and we may even see prices go backwards slightly especially late in the year. As I said last year, and I will say it again, this year the sellers who list in January/February/March will make the most money. Those who wait until summer when inventory goes up will sell for less due to less buyer competition and fewer bidding wars. The other wildcard for 2024 is there will be a Presidential Election and all indications point to it being a repeat of Trump vs. Biden, which means it will be another polarizing election with lots of frustration on both sides. Sales tend to dip in the weeks leading up to the election, so we did factor that into our predictions as well. In real estate the show always goes on regardless of circumstance, and 2024 will be a year filled with buyers buying, sellers selling, and the real estate market doing what it always does, which is move forward!

Happy Holidays and Happy New year!

– Anthony Lamacchia, Broker/Owner, Lamacchia Realty

Note: Many of These 2024 predictions and observations apply nationally on many levels. Though real estate markets can vary from one local market to another, the majority of the overarching market trends are happening everywhere on a grander scale right now. For those reading these predictions outside of New England or South Florida, much of this will likely be applicable to your market unless you are in a unique place with outlying factors.