In 2023, the Rhode Island real estate landscape underwent significant changes. A standout element was the unprecedented low number of homes listed; a trend not observed in over two decades. This resulted in an acute shortage of available properties, leading to another year of increased prices. However, it also translated into a notable 23.2% reduction in sales, leaving prospective buyers eager to make a move. As interest rates sought to stabilize following their sharp decline in 2020, both buyers and sellers had to acknowledge the end of the era of historically low pandemic-induced rates, and the beginning of higher monthly mortgage payments.

In 2023, the Rhode Island real estate landscape underwent significant changes. A standout element was the unprecedented low number of homes listed; a trend not observed in over two decades. This resulted in an acute shortage of available properties, leading to another year of increased prices. However, it also translated into a notable 23.2% reduction in sales, leaving prospective buyers eager to make a move. As interest rates sought to stabilize following their sharp decline in 2020, both buyers and sellers had to acknowledge the end of the era of historically low pandemic-induced rates, and the beginning of higher monthly mortgage payments.

2022 also witnessed a decline in sales compared to 2021, accompanied by attention-grabbing headlines that fueled concerns about an imminent market crash. However, Anthony made it clear at that time that such an outcome was unlikely. Fast forward to the present, and no crash has occurred. The market’s resilience can be attributed more to the decrease in inventory than the decline in sales. The dip in sales in 2022 was not surprising but rather a relief, considering the unsustainable frenzy of the 2021 market. The subsequent year’s slower market activity reflects a shift towards equilibrium. Despite the necessity of a market adjustment, the process can be painful, and 2023 was undoubtedly a challenging year for all involved.

This report, the first one we are publishing for Rhode Island, examines sales, average prices, the number of active listings, and listings under contract for 2023 compared to 2022. Additionally, it provides predictions for what is anticipated to unfold in real estate in 2024.

2024 Real Estate Performance Highlights

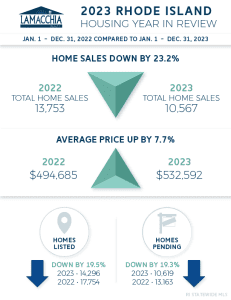

- The number of homes sold decreased by 23.2%

- Average prices for closed sales increased by 7.7%

- Lowest number of homes listed in recorded history, down 19.5%

- The number of homes placed under contract decreased by 19.3%

- The decline in inventory has made it impossible for prices to decrease due to demand.

- In conclusion… 2024 is predicted to improve if rates are stable and inventory rises a bit.

Sales Decline by 23.2%

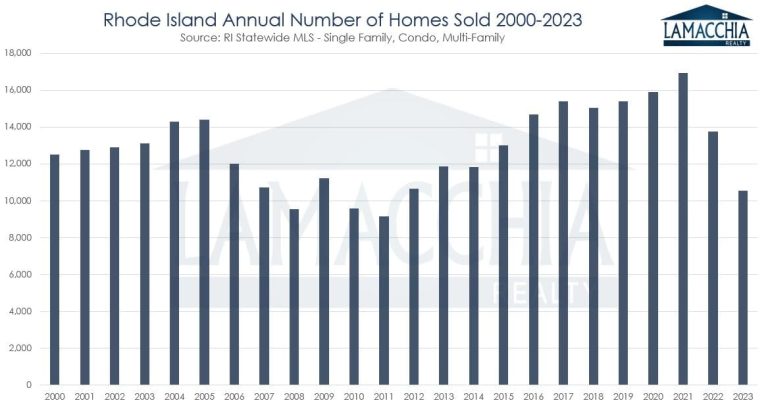

Rhode Island experienced a noteworthy 23.2% decrease in sales, with the numbers falling from 13,753 in 2022 to 10,567 by the conclusion of 2023. This signifies a decline of 3,186 sales year-over-year. The reduction is due to buyers contending with the affordability challenges brought about by elevated interest rates and continually rising prices. Furthermore, a major contributing factor was the insufficient inventory levels due to sellers not listing, establishing a challenging and competitive environment for prospective buyers.

Sales were down in all three categories:

- Single family sales down by 22.4%: 7,420 in 2023 from 9,565 in 2022

- Condo sales down by 21.7%: 1,685 in 2023 from 2,152 in 2022

- Multi-family sales down by 28.2%: 1,462 in 2023 from 2,036 in 2022

The bar chart below illustrates that sales in 2023 reached their lowest point since 2011. This marks the second consecutive year of a substantial decline in sales as the market endeavors to recover from the frenzied conditions of the 2021 COVID period. Sellers, reluctant to part with their low rates, are holding onto their properties, contributing to the ongoing inventory challenges and therefore causing sales to decline as they have.

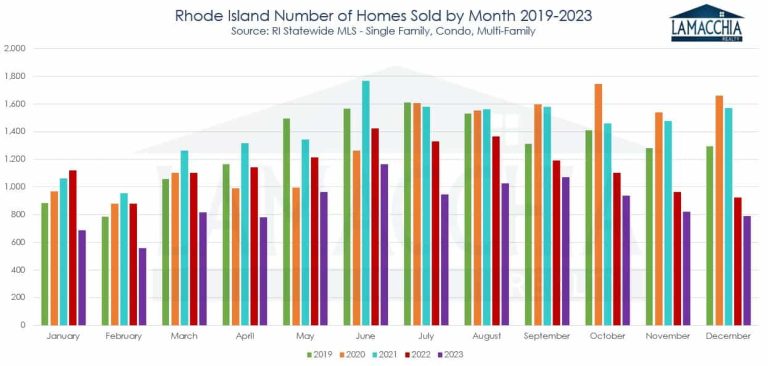

Moreover, the bar chart below clearly indicates that every month this year recorded a decrease compared to the corresponding months in the previous four years, including the pre-pandemic market. This consistent downward trend reflects the ongoing challenges and shifts in the real estate market throughout the entire year.

Average Prices Increase by 7.7%

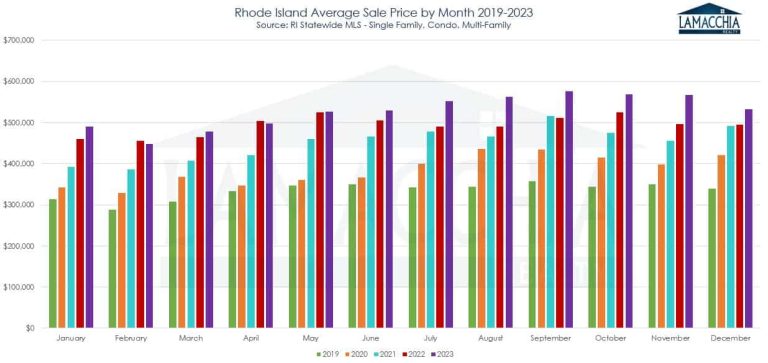

Despite of the affordability challenges exerting pressure, prices persistently rise due to the consistently low inventory. Motivated buyers find themselves in competition with multiple offers, resulting in an upward trend in sales prices.

Prices increased in all three categories:

- Single family prices increased by 5.9%: $557,761 in 2023 from $526,585 in 2022

- Condo prices increased by 14.8%: $442,947 in 2023 from $385,915 in 2022

- Multi-family prices increased by 10.5%: $508,174 in 2023 from $459,788 in 2022

The surge in prices was sparked by COVID in 2020 without much relief since. 2023 brought inventory to its lowest point in more than two decades, and the persistent demand keeps prices on the rise. Buyers engaging in competition with higher-priced offers contribute to the continuous upward trajectory of prices.

Monthly prices have been up year-over-year fairly regularly for the past four years. In 2023, February and April were the only months that were lower than the year before.

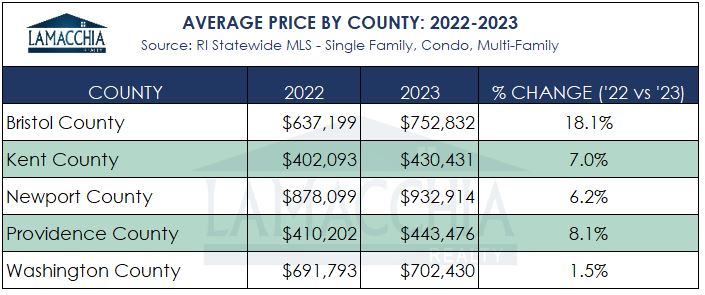

Prices in all Rhode Island counties experienced prices increases. Geographical expansion is evident as people spread out, creating demand across various areas, while the limited supply makes it challenging to meet the growing housing needs.

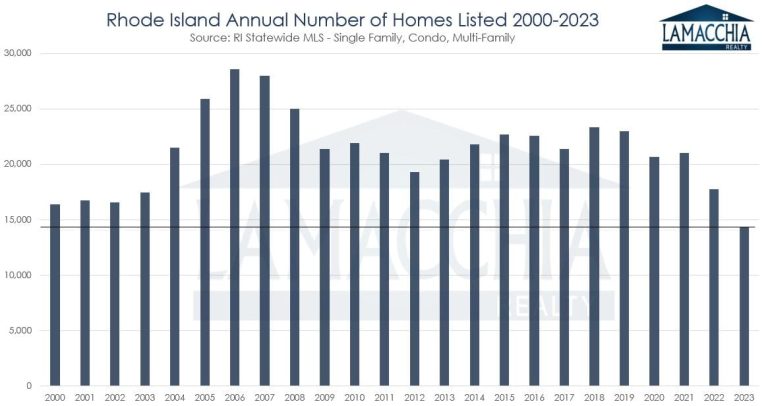

2023 Sees the Lowest Number of Homes Listed in Twenty-Three Years

In 2023, there was a notable 19.5% decline in listings compared to 2022, with 14,296 homes listed; down from 17,754. Sellers were cautious about listing their homes, not only to preserve pandemic-era rates but also due to concerns about higher monthly payments when making a new purchase. This hesitancy, spread over two years, has resulted in the lowest number of new listings since 2000.

Contrary to the notion that interest rates only impact buyers, 2023 demonstrates the impact on sellers. Their reluctance contributed to low inventory levels, intensifying buyer competition and preventing a drop in prices. While concerns about price declines may arise if inventory increases substantially, the current situation reflects the opposite trend.

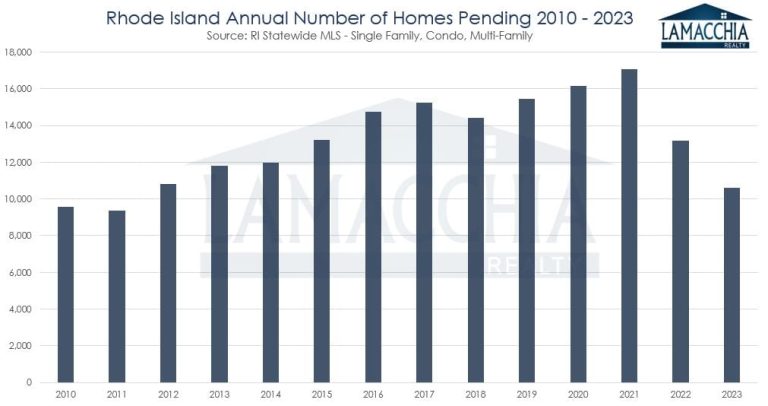

Pending Sales Decreased by 19.3%

The year 2023 ended with the lowest number of pending sales since 2011. Unlike previous challenges related to demand, the primary issue this time is the scarcity of supply. There were 10,619 homes placed under contract in 2023, representing a 19.3% decline from 2022, which recorded 13,163 pending sales. There simply aren’t enough homes available for sales to keep up with previous years.

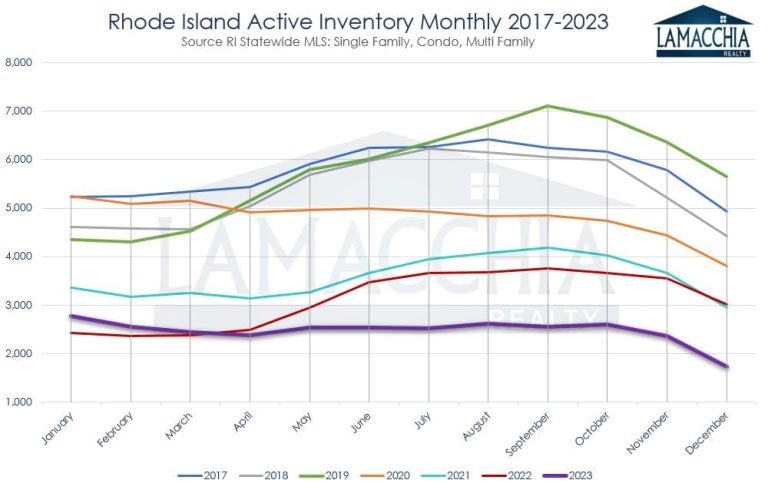

Rhode Island Housing Inventory is Anemically Low

With declines in listings, pending, and closed sales, the potential for an increase in inventory would typically be on the horizon. If sellers were to start listing more rapidly and pending and closed sales continued to decrease, there could be a rise in inventory; eventually exerting downward pressure on prices. However, for this to happen, sellers would need to suddenly list their properties in a manner comparable to the voracious buying trends observed among buyers. Unless this scenario unfolds, and sellers remain relatively inactive, prices are likely to stay consistent, with demand consistently outpacing supply.

In contrast to other northeastern states where inventory has seen occasional increases above the previous year in 2023, Rhode Island, like Connecticut, stands out as an outlier. Its inventory dropped in winter from the level in the new year and has remained relatively flat throughout the year and consistently below previous years, without the typical influence of seasonality or global events impacting consumer behavior. This highlights the scarcity of sellers listing their properties and the significant number of buyers struggling to find a home. The challenging market conditions, coupled with widespread awareness of the tough environment, contribute to homeowners choosing to stay put, creating a persistent and challenging cycle.

Will the 2024 Real Estate Market Improve?

Mortgage rates, which slowed down buyer activity in other states to aid a slight increase in inventory, did not have the same effect in Rhode Island. Buyers remained motivated to purchase, while sellers opted to stay on the sidelines to maintain their existing rates and mortgage payments. In 2021, the theme was buyer demand, followed by rapid increases in mortgage rates in 2022, and 2023 was marked by an extraordinary lack of inventory. Only highly motivated buyers and sellers experiencing significant life changes, such as divorce or relocations, were active in the 2023 market.

Looking ahead to 2024, the theme appears to be a potential reduction in pressure. Anthony’s 2024 Predictions suggest that “the worst is behind us, but we are not out of the woods,” indicating that while the market may continue to be sluggish, sales could increase if rates trend down and stay lower. This could incentivize sellers to list their properties, leading to a rise in inventory and potentially slowing the upward movement of prices, stabilizing them, or even causing a slight decline.

Buyers’ affordability will benefit from lower rates compared to 2023, and mortgage programs like buydowns and mortgage assumptions can contribute to securing these lower rates; but competition may be even higher if more buyers step into the market to take advantage of the lower rates. Sellers, in turn, can and should capitalize on the current low inventory and list now to make the most on the sale. Eventually, when rates settle into their new normal, which is possibly in a historically moderate 6% range, a more typical buyer and seller’s market cycle will fall back into place.