The Florida real estate market has shifted, and the number of active listings has increased at a much faster rate than the rest of the country over recent months. Condo sales in particular have experienced a significant decline in recent weeks which can be attributed to the ongoing insurance crisis in the state and to the increased association fees and/or added special assessments for condos due to the more stringent regulations resulting from the tragic Champlain Tower Collapse in Surfside, Florida. Not to mention higher interest rates.

Elevated condo association and special assessment fees present an additional financial burden for condo owners, deterring potential buyers unless the purchase price is reduced sufficiently to offset the higher ongoing monthly costs. The cost of home insurance in Florida has surged over the past few years, making it more expensive than the national average. Additionally, it’s hard for most people to wrap their heads around a rate that is basically 5% higher than it was a couple years ago as that alone increases the monthly payment for a property, particularly because this is also a second home market.

Many people during the pandemic moved to Florida when working from anywhere was prevalent. In-migration to Florida was at an all time high as a result, but now that work-from-work is becoming the norm once again, those second homes are more a financial burden than an escape. As soon as holding onto a second home is challenged by affordability and other personal financial strains, offloading that second home is generally first on the list.

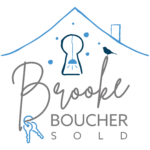

Due to these rising costs and rising number of listings, condos are remaining on the market for much longer periods than before, attracting less interest from buyers. As you can see in the chart below, Florida has the highest shift in rising inventory over the past twelve months.

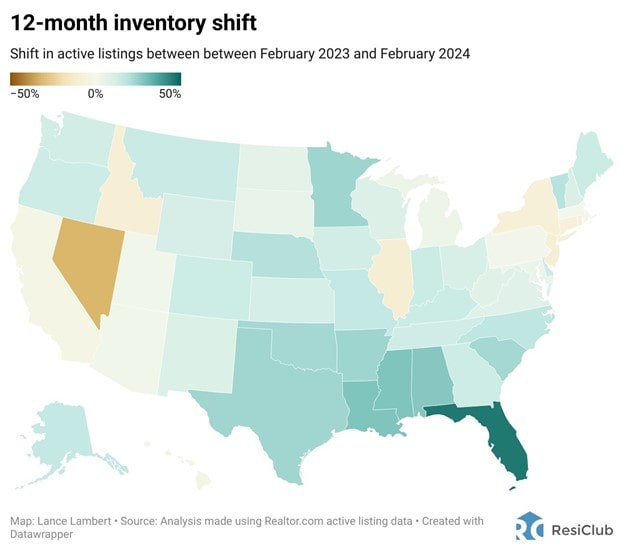

Condo inventory has been rising more than single families as sales have been decreasing since 2023. In the chart below, the trend depicts that inventory in all three South Florida counties (Palm Beach, Miami-Dade, and Broward) has been rising since April of 2022. Inventory isn’t as high as it was during the pandemic, but it is continuing to rise and with costs not expected to decline, this trend is likely to continue.

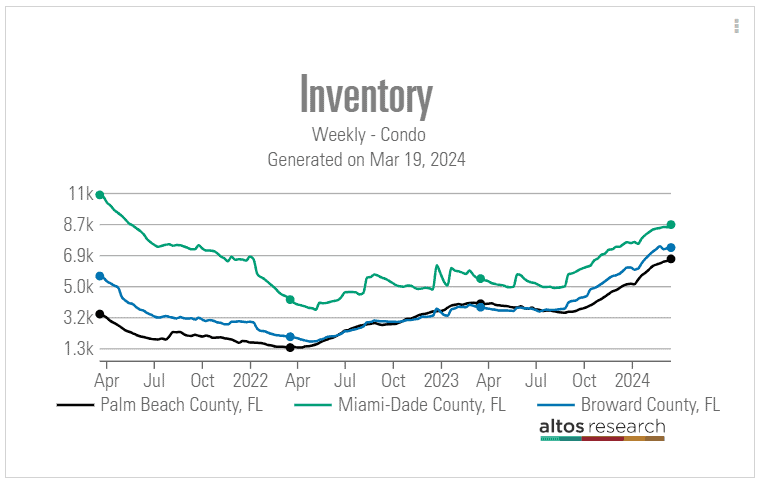

Inventory rises when more sellers are listing than buyers are buying. When that becomes the case, homes can sit on the market for longer and longer. The chart below shows the median time to contract, which is the number of days it takes for the property to be considered off the market. Since June of 2023, the time has risen from 28 days to 45 days in February of 2024. When there are market changes it often takes sellers time to first realize it and then be willing to accept it.

Home sellers in Florida whose listing has been active for more than two weeks without much buyer interest should consider adjusting their listing for several reasons:

- Buyer Affordability: As insurance and HOA fees rise, the overall cost of owning a home increases. Prospective buyers take these ongoing costs into account when deciding how much they can afford to spend on a purchase. Higher ongoing costs can significantly reduce the pool of buyers who can afford or are willing to pay the asking price.

- Market Competitiveness: Sellers who adjust their listing prices to reflect the reality of higher ongoing costs may make their properties more attractive compared to others on the market. This can be particularly important in a buyer’s market, where buyers have many options and sellers need to stand out.

- Speed of Sale: Adjusting the price to account for higher insurance premiums and HOA fees can lead to a quicker sale. Properties priced more in line with the true cost of ownership are likely to attract more interest, reducing the time the property sits on the market.

- Closing the Deal: Realistic pricing that considers the total cost of ownership is more likely to lead to successful negotiations with buyers. If a property is perceived as overpriced given the additional costs, buyers may be more hesitant to make an offer, or negotiations may stall.

- Market Dynamics: In a changing real estate market, especially one facing increasing costs of ownership, staying ahead of trends can be crucial. Sellers who proactively adjust their pricing strategy in response to rising costs can avoid the pitfalls of a stagnating listing, such as having to make more significant price reductions later or facing the perception that there is something wrong with the property.

- Perception of Value: Finally, pricing a home appropriately in the context of higher insurance and HOA fees can help ensure that the property is perceived as a good value. This perception is critical in attracting serious buyers who are ready to make a decision. The more buyers that are attracted to the property, the more likely it will sell at an attractive price for the seller.

Adjusting listing prices in response to increased insurance premiums and HOA fees is a strategic move that can align sellers with the current realities of the Florida real estate market, enhancing their ability to sell efficiently and effectively.

An experienced REALTOR® will make it very clear from the beginning that pricing right is the key to selling faster and for more money. But even with all the data at hand, determining the exact price isn’t always easy, especially in a shifting market like we have seen since the beginning of the year. There are factors such as comparable active properties, time of year, recently sold properties in your area, condition of the property, mortgage rates, and current market conditions to take into consideration when pricing a home. Even if the home is priced appropriately, the market could shift quicker than anticipated and a price adjustment may be the next best step. As well, looking at a home in which the offer was accepted in January will not have a comparable list price to a similar home listed now as the market is different.

How do you know your house or condo is overpriced?

1. Your home is priced much higher than properties in your area

Your REALTOR® will conduct a comparative market analysis of recently sold homes in your area to set a target price range. Homes in the same neighborhood with similar size and condition typically have comparable values. Pricing your home even 5% above others could lead to it being overlooked, indicating a need for a price adjustment.

2. Few showing requests

Besides photos, the list price is the first detail that catches buyers’ attention. If the price doesn’t match the home’s appeal and location, potential buyers may lose interest. A lack of showing requests or a poor turnout at an open house signals it might be time to reconsider and reduce your listing price to draw more interest. Remember, buyers think in terms of their monthly payments, not the total mortgage cost, so understanding what buyers will need to spend monthly to purchase your home can be advantageous for sellers.

3. No offers in the first few weeks of being on the market

A lack of strong offers on your home could indicate it’s not priced right. Normally, sellers should expect at least one offer within the first two weeks of listing. If three weeks pass without serious interest, it’s advisable to consult with your REALTOR® about adjusting the list price.

4. Your agent recommended the highest listing price

Choosing the REALTOR® who suggests the highest listing price for your home isn’t always the smartest move. It may indicate a lack of market understanding, potentially leading to underperformance. Ensure you comprehend the reasoning behind their suggested price by requesting recent and active comparable sales in your area. If their suggested price significantly deviates from these comparables, you risk missing out on a quick and competitive sale.

When and how much should you adjust the price?

If you’re questioning the need for a price adjustment, it’s probably time to make one. A lack of strong offers or interest three weeks into the listing should prompt a price change. Delaying the inevitable only postpones attracting more buyers, showings, and offers.

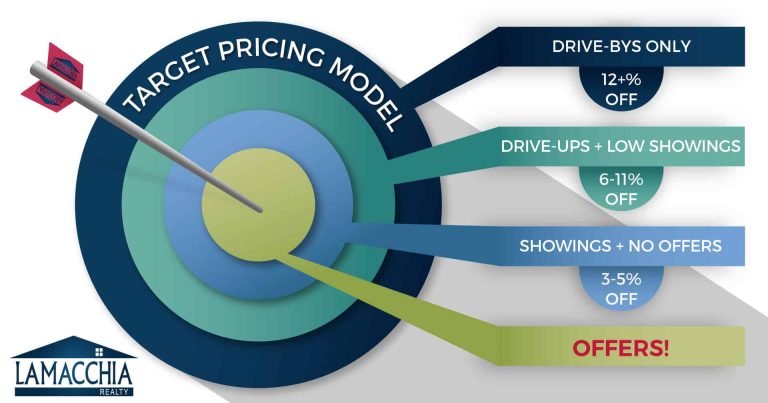

Since 2005, Lamacchia Realty has utilized data to refine a pricing model for homes, introducing the Lamacchia Realty Target Pricing Model in 2007. Even with efforts to price homes correctly from the start, adjustments may be necessary to engage more interested buyers.

The accompanying graphic illustrates how to gauge the necessary price reduction. Being in the “bullseye” means your home is priced correctly and attracting strong offers. If you’re outside that zone, the graphic suggests the extent of adjustment needed to realign with market expectations.

Get Your Price on Target

- If your home is receiving showings but no offers, somewhere between a 3-5% adjustment should be made.

- If you’re receiving a small number of showings and only some drive ups, you probably need somewhere between a 6-11% adjustment.

- Not getting any showings at all is a red flag that at least a 12% adjustment is necessary. When this happens, sellers are usually the most hesitant to adjust because they just cannot believe no one has even come out to see the house.

There are factors and variables involved in a price adjustment that your experienced Realtor will be able to review with you.

Consider the Price Bracket

Along with comps and the Target Pricing Model, price brackets are a helpful tool to use when adjusting the price of your home. Simply put, lowering your price to the next bracket will expose your home to those people searching within that next price range.

Some real estate websites set up their property search tools with price brackets. The person searching for a home will select the area, the number of beds, baths and as well, their price range. If your home is currently listed at $475,000, everyone searching for homes in the $450K to $500K range will see it, but you’re missing every person searching for homes under $450K.

The limitation with only following the Target Pricing Model is that if you are on the market at $429,000 and you adjust your price by say 5%, you will end up at an adjusted price of $407,550. If that is what the target pricing model calls for you can do it but, in this case, it would be a lot smarter to shift down to $400,000 so that you can reach new buyers. Your home will fall into two brackets, the $350K to $400K as well as the $400K to $450K, if they’re in $50K increments. Although you’re listing for $7,550 less, you may receive multiple offers which could develop a bidding war. Bidding wars generally get homes sold for over asking, so you could theoretically make that money up in the end.

When a listing in MLS has a price change, agents are notified as well as buyers with saved searches that match the home’s criteria. This is an incredibly effective way to gain interest in a listing that has otherwise sat on the market without much of a response.

Final Thoughts

Sellers often perceive their home’s value as higher, making a price reduction feel like an admission of lesser worth. This emotional reaction to a fundamentally business decision is natural, yet it does not contribute to the ultimate goal of maximizing the sale price.

For sellers facing a lack of buyer interest, reducing the list price is the most effective strategy to quickly attract more buyers and generate demand.

As mentioned in our previous blog, there are 5 considerations when pricing a home. Exploring comparative sold properties, the market climate when those comps were sold, comparative active properties, the current inventory and the current market. Even if the seller and their experienced agent do their best to price well, it may become evident that an adjustment is in order after a few weeks. Using the target pricing model and revisiting those 5 considerations along with paying attention to the price bracketing will help refocus that target price and get your home sold.