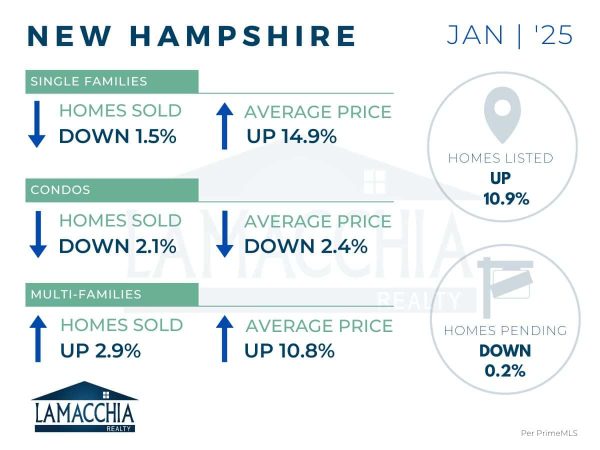

NEW HAMPSHIRE

Home Sales Down, Average Price Up

Home sales are down 1.3% year over year, with January 2025 at 955 compared to 968 last January. Sales are down for Single-family homes and condos, but up for multi-family homes.

- Single families: 666 (2024) | 656 (2025)

- Condominiums: 233 (2024) | 228 (2025)

- Multi-families: 69 (2024) | 71 (2025)

Average sale price increased by 10.6% when compared to last January, now at $575,855. Prices increased for single and multi-family homes but decreased for Condos

- Single families: $530,793 (2024) | $609,643 (2025)

- Condominiums: $501,064 (2024) | $489,098 (2025)

- Multi-families: $489,323 (2024) | $542,270 (2025)

Homes Listed For Sale:

The number of homes listed is up by 10.9% when compared to January 2024.

- 2025: 1,233

- 2024: 1,112

- 2023: 965

Pending Home Sales:

The number of homes placed under contract is down by 0.2% when compared to January 2024.

- 2025: 1,119

- 2024: 1,121

- 2023: 1,091

Data provided by PrimeMLS then compared to the prior year.

What’s Happening in the Market?

- In January 2025, national home sales increased 2% compared to a year ago, Despite this trend, New Hampshire saw a decrease in home sales.

- Anthony Lamacchia states “Homes listed for sale being up is especially notable considering we are in the midst of the coldest and snowiest winter in a few years. This tells me homes listed will shoot up ALOT more once the weather breaks. Sellers should take note of this and not push their luck too much when pricing and buyers should be happy to have a few more choices. In a month buyers will have many more choices.”

- In New Hampshire, home prices continue to rise, and more homes are being listed. However, overall sales have declined, and pending sales have dipped slightly, indicating a slight moderation in demand. Despite these shifts, the market remains competitive. Planning to sell in 2025? Here are expert tips to get the most for your property!

- According to Mortgage News Daily, mortgage rates in January started in the low 7s, peaked at 7.25% mid-month, and then trended downward, ending in the low 7s. So far, February continues to show a declining trend.

- In this current market, increasing your home’s value is more important than ever. Easy, cost-effective upgrades can help your property stand out and attract top-dollar offers. Check out our easy ways to boost your home’s worth before you list!

- With condo sales and prices declining, the market is shifting. While lower prices may be appealing, it’s essential to consider factors like HOA costs, long-term resale value, and financing options before making a purchase. Here’s what to keep in mind before buying a condo in this changing market.