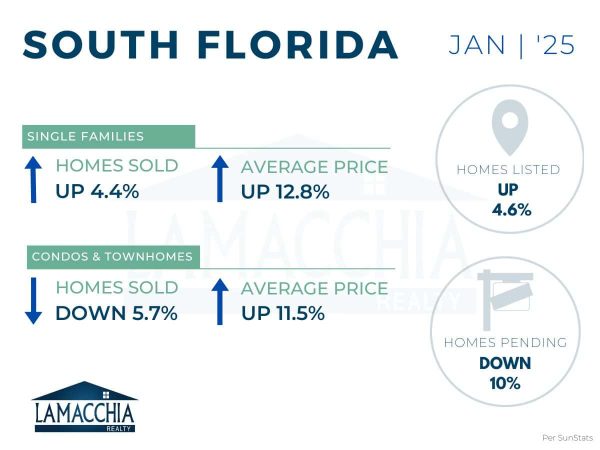

SOUTH FLORIDA

Home Sales Down, Average Price Up

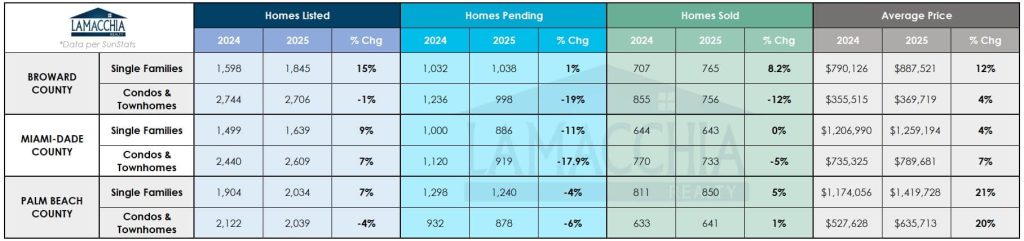

Home sales are down 0.7% year over year, with Janaury 2025 at 4,388 compared to 4,420 last January. Sales are up for single-fmaily homes and down for Condos.

- Single families: 2,162 (2024) | 2,258 (2025)

- Condos & Townhomes: 2,258 (2024) | 2,130 (2025)

Average sale price increased 14.1% year-over-year, now at $902,816 compared to $790,097 in January 2024. Prices increased across all categories.

- Single families: $1,058,316 (2024) | $1,193,575 (2025)

- Condos & Townhomes: $533,283 (2024) | $594,586 (2025)

Homes Listed For Sale in South Florida:

The number of homes listed is up by 4.6% when compared to January 2024.

- 2025: 12,872

- 2024: 12,307

- 2023: 9,929

Pending Home Sales in South Florida:

The number of homes placed under contract is down by 10% when compared to January 2024.

- 2025: 5,959

- 2024: 6,618

- 2023: 7,282

Market data provided by SunStats then compared to the prior year.

What’s Happening in the South Florida Market?

- In January 2025, national home sales increased 2% compared to a year ago, Despite this trend, Florida saw a decrease in home sales.

- Home prices in Florida are still on the rise, with more homes hitting the market. However, overall sales and pending transactions have slowed, indicating a shift in demand. Thinking about selling in 2025? Here are expert tips to get the most for your property

- According to Mortgage News Daily, mortgage rates in January started in the low 7s, peaked at 7.25% mid-month, and then trended downward, ending in the low 7s. So far, February continues to show a declining trend.

- In a market where interest rates remain high and competition is intense, boosting your home’s value is key. Simple, cost-effective improvements can make a big impact and attract top-dollar buyers. Check out these simple ways to boost your home’s worth before you list!

- If you’re buying, it’s crucial to assess a property’s hurricane risk—considering flood zones, wind ratings, and insurance costs. Here’s what to know before making your move!